Tax back calculator

It can be used for the 201516 to 202122 income years. Use the free UK tax refund calculator today.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

This calculator is for 2022 Tax Returns due in 2023.

. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Before applying for your Irish tax refund its good to. As with all our free calculators this is an approximate figure that you will firm up when preparing your.

Estimate your federal income tax withholding. You have to give a. If you have more than one IRP5IT3a please enter totals for all of them added.

Discover Helpful Information And Resources On Taxes From AARP. Before you use the. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. How It Works. Step 3 Add the total amount of tax.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. This calculator will help you work out your tax refund or debt estimate. Did you work for an employer or receive an annuity from a fund.

Irish Tax Refund Calculator. See how your refund take-home pay or tax due are affected by withholding amount. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Calculating your UK Tax Refund is super simple. Which tax year would you like to calculate.

Get help Apply Now Download the. Answer the simple questions the calculator asks. But how much can YOU claim.

The amount of tax you will get back in this years refund depends on factors such as your income number of dependents and type of deduction. Your household income location filing status and number of personal. Step 1 Select the tax year you want to claim for.

Use this tool to. Effective tax rate 172. Our Tool Tax Back Calculator gives you an idea of how much your claim could be worth.

The tax bracket calculator is one of many FlyFin features geared specifically toward freelancers and the self-employed. The AI-powered tax engine finds every possible tax deduction to. Step 2 Add in your gross total pay for that tax year.

It takes just 2 minutes to use and could lead to you getting a significant amount of UK tax back. Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator. You dont have to be 100 exact.

You can estimate the amount of. Ad Aprio performs hundreds of RD Tax Credit studies each year. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

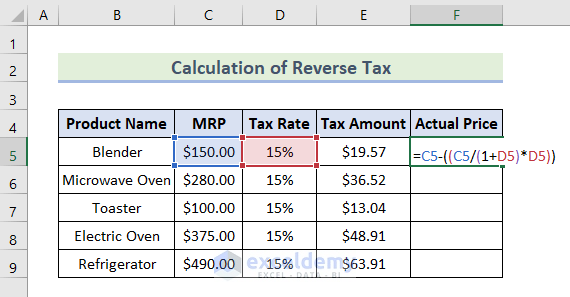

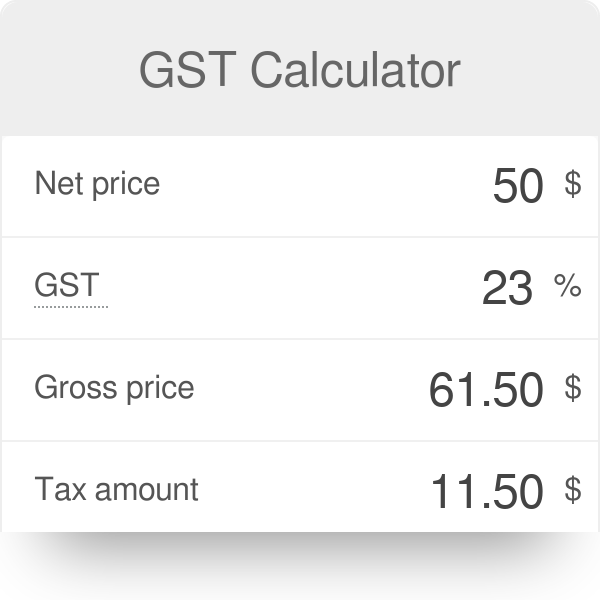

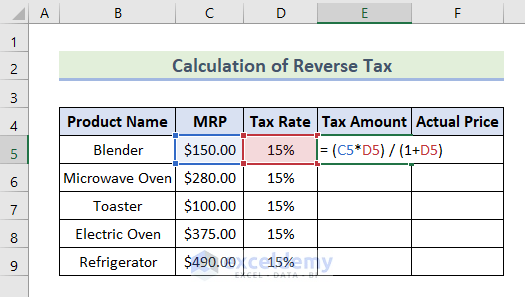

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Property Tax Calculator

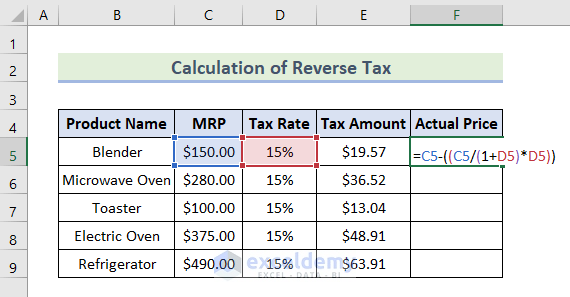

Gst Calculator

Reverse Sales Tax Calculator

Lottery Tax Calculator

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Federal Income Tax Calculator Atlantic Union Bank

Effective Tax Rate Formula Calculator Excel Template

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Sales Tax Calculator

Tax Return Calculator How Much Will You Get Back In Taxes Tips

How To Calculate Federal Income Tax

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Excel Formula Income Tax Bracket Calculation Exceljet

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Year 2022 Calculator Estimate Your Refund And Taxes